by John Cleary, Board Treasurer

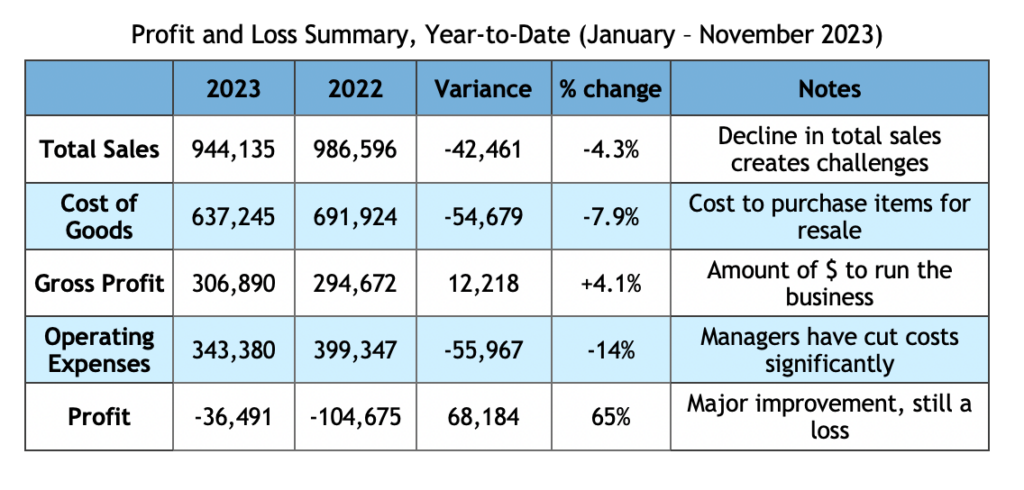

This report covers the financials from January 2023 through the end of November 2023. Complete 2023 financials will be available in early 2024. The business continues to face the long-term challenges that we have discussed before — declining annual sales, limited cash reserves, high wage costs as a percentage of sales, and lack of investment in the business. There have been some significant improvements in operations to manage these challenges. While sales have declined by 4.3% compared to last year, total operating expenses have been reduced by 14%. Labor costs have been reduced, with the store being operated by fewer staff. While this has resulted in labor savings of almost $60,000, there is concern about the sustainability of continuing to ask staff to do more. Store-wide margins have improved from 30% to 33%. Managing margins while keeping prices competitive with other outlets is a balancing act. While we have made significant financial progress compared to last year, the Co-op is still facing a year-to-date loss of $36,491. We have achieved small monthly profits in 5 of the 11 months covered by this report. The chart below provides more details on key Profit and Loss financials compared to last year.

The Balance Sheet of the Co-op remains stable. A Balance Sheet shows assets and liabilities at a point in time. Comparing numbers at the end of November 2023 compared to November 2022, there are some changes to cash and inventory. Cash on hand is lower ($60,901 vs $85,982) and the value of Inventory is higher ($62,042 vs $46,146). If you combine cash and inventory you see the value of our current assets to be $124,502 in 2023 vs $131,123 at the same time in 2022. Current liabilities (short term debt) has improved slightly but continues to be a burden on cash flow. Accounts payable (money owed to vendors) was $93,677 vs $114,557 last year. This is a worrying sign for a business and needs to be addressed. The only long-term debt is our loan with the Cooperative Loan Fund of New England, with a balance of $42,743. Our business could be described as having poor cash flow but a manageable amount of total debt. Improvements in monthly profitability are necessary. Continued attention to margins, inventory and wage costs can help. Longer term, growth in sales is required to maintain the viability of the business.