by John Cleary, Board Treasurer

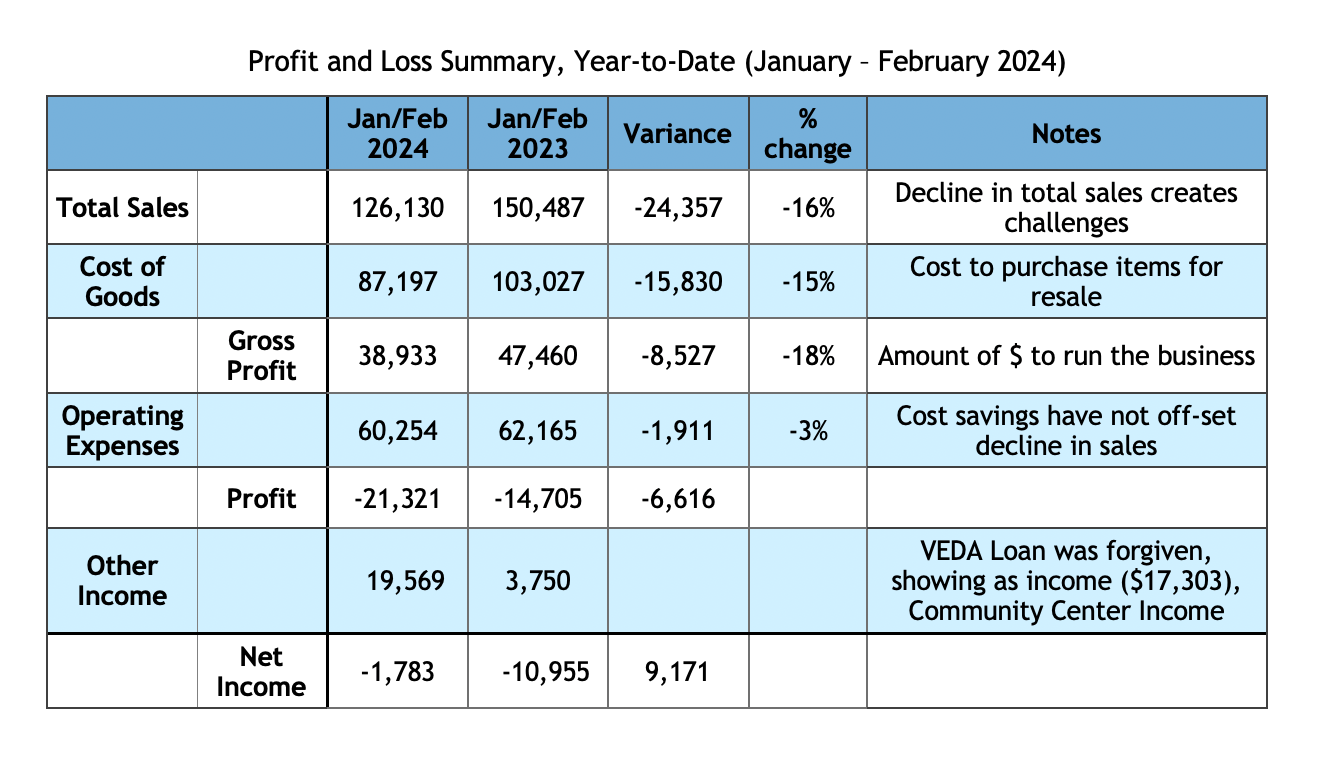

This report covers the financials for the first two months of 2024. The business continues to face the long-term challenges that we have discussed before—declining annual sales, limited cash reserves, high wage costs as a percentage of sales, and lack of investment in the business. Wages as a percentage of sales must be reduced and this effort is underway. Our Columinate consultant is working with store Buyers to better manage purchasing and margins. While we are excited to move forward with the hardware store expansion and move project, we need to keep the current store running in the meantime. The chart below provides more details on key Profit and Loss financials compared to last year.

The Balance Sheet of the Co-op shows that losses from last year were covered using funds from savings. A Balance Sheet shows assets and liabilities at a point in time. Comparing numbers at the end of February 2024 compared to February 2023, cash on hand is significantly lower ($31,322 vs $91,249) and the value of Inventory is slightly lower ($45,121 vs $55,223. Current liabilities (short term debt) has improved but continues to be a burden on cash flow. Accounts payable (money owed to vendors) was $66,513 vs $113,917 last year. In January 2024, our VEDA Forgivable Loan ($17,303) was forgiven. The only long-term debt is our loan with the Cooperative Loan Fund of New England, with a balance of $44,554. Improvements in monthly profitability are necessary. Continued attention to margins, inventory and wage costs can help. Longer term, growth in sales is required to maintain the viability of the business.

It is my assessment that the project to purchase Plainfield Hardware and expand at that location is the only viable path forward for the Co-op. If the Co-op were to stay at the current location and current trends continued, the business would likely become insolvent and close by the end of the year. The good news is that the Route 2 expansion is financially viable and the 10 year projections show the business quickly becoming profitable and in fact, doing very well. We have signed a purchase and sale agreement with the hardware store owners and are moving forward quickly. Our financing plan (loans and capital campaign) will fund the purchase of the hardware store business as well as providing money to cover current debt and adequate cash for operations both during the transition and beyond. The entire project has a budget of around $2 million dollars. The financing plan is coming together very successfully so far, with $1,550,000 secured. The remaining balance will be raised through member loans. This capital campaign is being launched with the help of several experienced fundraising consultants. Keep your eyes out for the loan offering details, which will be released as soon as the review and approval process has been completed by the VT Department of Financial Regulation. The Board of Directors has worked hard on this plan with our consultants and feel confident that it is realistic and achievable if the community works together to support our Co-op.